We live in Paradise, but it could be gone in a flash.

This is fire country after all, with beetle kill encroaching all around us and the weather getting hotter and drier every year. And since we live in the most remote county in the lower 48, our volunteer fire department is our first and only line of defense. We must be prepared. We must provide our firefighters with everything they need to keep our community and themselves safe.

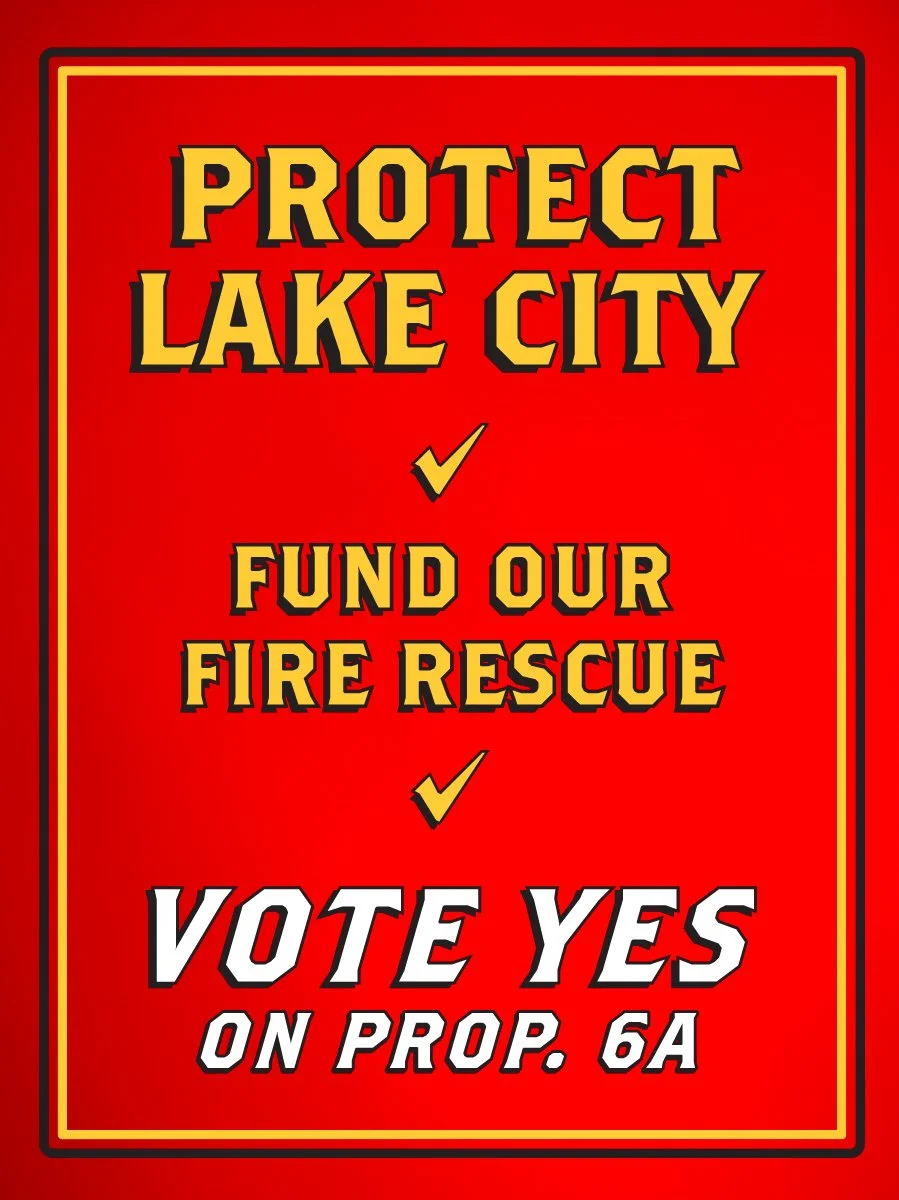

We are seeking a 1.25% sales tax to ensure continued fire protection services for our community.

For 43 years, the Lake City Area Fire Protection District has served our community without seeking an increase in tax revenues. Recent significant increases in operating costs, facility and maintenance costs, equipment costs, and personnel costs have outpaced our revenues. Today, we need your support to continue protecting what matters most.

Your YES vote will fund:

Essential personnel (Fire Chief, Fire Marshal, Facilities Manager, Administrative Assistant)

Training for volunteer firefighters

Equipment maintenance and replacement

Facility improvements and expansion

Long-term financial stability

Join us for an Open House at the Fire House

Thursday, October 2, 5:30 til 7:30

✓ Take a tour ✓ Meet your firefighters ✓ Eat some chili ✓ Talk about Prop. 6A

Voting Information

-

Tuesday, November 4, 2025

-

To vote on Proposition 6A, you must:

· Be registered to vote in Colorado

· Reside in or own property that lies within District boundaries

-

Contact the Hinsdale County Clerk's office at 970-944-2225.

-

Lake City Area Fire Protection District - Ballot Issue 6A

SHALL THE LAKE CITY AREA FIRE PROTECTION DISTRICT TAXES BE INCREASED BY $425,000, COMMENCING IN 2026 (FIRST FULL FISCAL YEAR), AND BY SUCH AMOUNT AS MAY BE RAISED ANNUALLY THEREAFTER BY THE IMPOSITION OF A SALES TAX TO COMMENCE ON JANUARY 1, 2026 AT A RATE NOT TO EXCEED 1.25%, SUCH SALES TAX TO BE IN ADDITION TO ALL OTHER TAXES LEVIED BY THE DISTRICT, WITH THE PROCEEDS OF SUCH TAXES USED BY THE DISTRICT FOR FIRE PROTECTION SERVICES, FIRE CODE INSPECTION SERVICES, MAINTENANCE, REPAIRS, SUPPLIES, AND OPERATING COSTS INCLUDING, BUT NOT LIMITED TO AVOIDING SERVICE LEVEL CUTS AND MAINTAINING AND OR IMPROVING EMERGENCY RESPONSE TIMES; PROVIDING ESSENTIAL SAFETY AND COMMUNICATIONS EQUIPMENT, AND CAPITAL IMPROVEMENTS INCLUDING REPLACEMENT OF AGING EMERGENCY RESPONSE VEHICLES, REPAIR AND MAINTENANCE OF THE EXISTING LAKE CITY AREA FIRE PROTECTION DISTRICT FACILITIES AS WELL AS THE CONSTRUCTION OF ADDITIONAL FACILITIES TO MAINTAIN CRITICAL INFRASTRUCTURE FOR CURRENT AND FUTURE DISTRICT NEEDS AND SHALL ALL REVENUE FROM SUCH TAXES AND ANY EARNINGS THEREON BE COLLECTED, RETAINED, AND SPENT AS A VOTER-APPROVED REVENUE CHANGE WITHOUT LIMITATION OR CONDITION, AND NOTWITHSTANDING ANY REVENUE OR EXPENDITURE LIMITATIONS CONTAINED IN ARTICLE X SECTION 20 OF THE COLORADO CONSTITUTION OR ANY OTHER LAW?

-

This election is a “mail ballot” election. In-person voting will not be available.

Ballots will be mailed out to all registered voters on October 10, 2025. (can’t say exactly when they will be received, though those with Lake City addresses will probably get them the next day)

Completed ballots can dropped off at the Hinsdale County Clerk’s office, deposited in the secure drop box located outside the Hinsdale County Courthouse, or mailed using the envelope provided. If mailing, please be sure to allow enough time for the ballot to be received by November 4, 2025 (election day).

Frequently Asked Questions

After 43 years without requesting an increase in taxes, why do you need the funding now?

Several factors have created a perfect storm of financial challenges:

Our longtime District Manager who filled multiple roles has retired.

Workers' compensation premiums increased 195% in 2024.

Dispatch costs rose 40% in 2025.

Equipment and maintenance costs continue to climb.

Our facility has reached capacity.

Grant funding is increasingly competitive and uncertain.

Why a sales tax?

The only other option for additional funding would be a significant property tax increase that would be fully shouldered by our property owners. A sales tax is shared among both residents and visitors, ensuring a broader base of support for public safety without disproportionately impacting property owners.

If the sales tax increase passes, how will our combined sales tax compare with other mountain towns?

Even with a 1.25% increase, we would still have a lower combined tax rate (9.15%) than most of the towns in our area. For comparison, the combined sales tax rates for other mountain towns are:

• Silverton:10.4%

• Ouray: 9.45%

• Creede: 9.5%

• Crested Butte: 9.4%

• South Fork: 9.5%

Will the new sales tax be used to benefit other emergency services organizations?

No. EMS and Search and Rescue are separately funded by Hinsdale County and are seeking their own funding by other means.

What is an ISO rating and why does it matter?

The Insurance Services Office (ISO) assigns a Public Protection Classification (PPC) to fire departments across the country on a scale of 1 to 10 with 1 being the best. This classification is an indication of a fire department’s capability and readiness to respond to fire incidents. It is based on training, equipment, communications, and water supply. The Lake City Area Fire Protection District has improved its PPC from a 10 (unprotected) in 1982 to its current PPC of 3/3Y achieved in 2022. This is among the highest in the country for a rural volunteer fire department..

Will any of the money go toward firefighter salaries?

Our firefighters are volunteers who receive only minimal stipends for training and emergency responses. The tax will fund professional staff positions that are essential for operations, training, and administration.